Your essential guide to insurance

BY NOELLE KAUFFMAN, DIRECTOR OF SALES (CA License No: 0H45598)

‘All you need is love. But a little chocolate now and then doesn’t hurt.”

– Charles M. Schulz

Love Is in the Air, Retirees!

Tip for Retirement: Retirement is the perfect time to pick up an old hobby or discover a new one, especially if it involves physical activity or exercising your mind! Some ideas could be walking around your neighborhood, hanging out with family members or friends, traveling to a place near or far you have never been before, making a new recipe, or even getting a pet such as a dog or cat! Try something new during this fun chapter of your life.

Give the gift of security and peace of mind to your loved ones this Valentine’s Day season by reviewing your Club benefits to make sure you and your family are protected and prepared for the future.

The Club is your resource for saving money through our discount programs, having financial security with our life insurance, and staying connected to your community.

Get Your Finances in Order

Organize your money so you can work out what you’ll have to live on. Gradually reduce your spending in the time leading up to retirement to make it easier to adjust. The Club partners with My Club Deals that provides Member discounts on dining, attractions, travel, shopping, services and more. There are more than 75,000 two-for-one and 50-percent-off deals!

Get your Insurance Policies in Order

Review your Club insurance benefits and decide how much life insurance you will need in retirement.

- A life insurance policy can provide an income for your spouse as they wait for your retirement benefits to transfer; cover funeral and burial expenses; and provide for any loved ones who rely on your income.

- Coverage is available for Members, spouses and dependent children

- Benefits range from $10,000 to $50,000.

Speak to a Club Retirement Specialist. Do not wait!

Don’t hesitate to contact our Retiree specialists at info@employeesclub.com or (800) 464-0452

Club Life Insurance Designed for Retirees

Lets discuss Retiree Life Insurance!

A life insurance benefit can help pay for things such as final expenses, outstanding debt and loss of income.

Life insurance can also be used to replace all or a part of your spouse’s pension benefits.

Have peace of mind knowing that your loved ones will be taken care of in the event of your passing.

The Club provides Group Rated Term Life Insurance for its Members, convenient payroll deduction, and an in-house claims department that works directly with your loved ones to make sure the claims process is as seamless as possible.

Continue Your Club Connection!

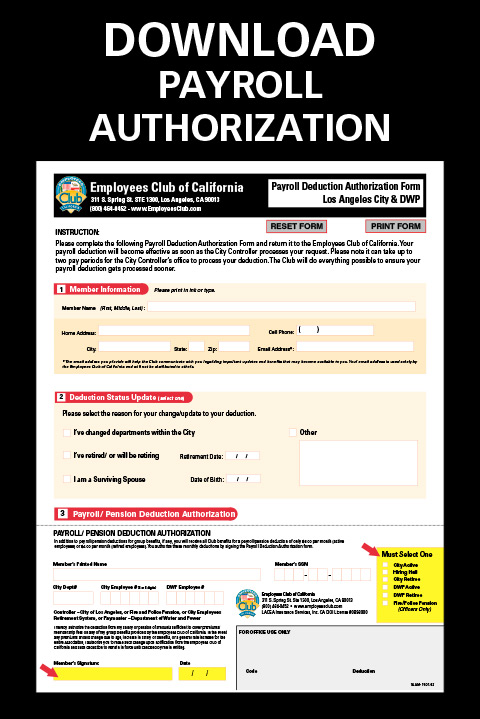

Very Important: If you have not contacted the Club yet to complete a form to have your Club Membership and/or insurance deducted from your pension, please do so ASAP! Even if you are not newly Retired, please call (800) 464-0452 or email help@employeesclub.com and let us know that you are a Retiree and need to complete a pension form. Never worry about a bill or late payment. Pension deduction is the most convenient and easiest way to handle your deductions. Offered to Club Members.

Download the form here, complete it and email it to info@employeesclub.com. Or mail it to:

Employees Club of California

Attn: Member Services

311. S. Spring St., Suite 1300

Los Angeles, CA. 90013

LACEA Insurance Services, Inc. (Employees Club of California) is a licensed insurance agency offering insurance benefits to qualified Club members. The Club’s CA DOI Lic. is #0B98000.

Resources for Club Retirees or Those About to Retire

2024 EventsLARFPA and LADWP Retirees Association 2024 events to be announced. Reservation information: LADWP Retiree Association: LARFPA: |

Contact InformationEmployees Club of California LA City Employees’ Retirement System (LACERS) (City Dept.) LADWP Retirees Association Fire and Police Pensions (City Dept.) LA Retired Fire and Police Association (LARFPA) Retired Los Angeles City Employees, Inc. (RLACEI) |

For ACTIVE MEMBERS

Are You Ready for Retirement?

Here are some current programs to help with your planning.

Learn about your retirement options and benefits at an upcoming Planning for Retirement webinar, hosted by the LACERS Member Engagement team. Register via your MyLACERS account. Upcoming dates include:

Thurs., Dec. 14 (webinar begins at 5 p.m.)

Wed., Jan. 10 (webinar, Tier 3)

Sat., Jan. 20 (in person)

Thurs., Jan. 25 (webinar)

All webinars/events begin at 9 a.m. unless noted

Applying for Retirement Online

Members are encouraged to submit their retirement application 60 days before their retirement date when using LACERS’ new Retirement Application Portal (RAP). The RAP is a great asset to LACERS Members that helps to streamline the retirement process. While the filing period is within 30 to 60 days of your retirement date, starting your application early and submitting it on the first day you can at the 60-day-prior mark, will allow for a couple of benefits. These include having ample time to discover any complications and address them without having to move your retirement date, as well as ensuring LACERS staff has time to meet your retirement date request.

Members are encouraged to submit their retirement application 60 days before their retirement date when using LACERS’ new Retirement Application Portal (RAP). The RAP is a great asset to LACERS Members that helps to streamline the retirement process. While the filing period is within 30 to 60 days of your retirement date, starting your application early and submitting it on the first day you can at the 60-day-prior mark, will allow for a couple of benefits. These include having ample time to discover any complications and address them without having to move your retirement date, as well as ensuring LACERS staff has time to meet your retirement date request.

For example, if your desired retirement date is Feb. 10, 2024, you would have aimed to submit your retirement application in the portal on Dec. 12, 2023. For more information, please visit lacers.org/applying-retirement.

![]()