Your essential guide to insurance

BY NOELLE KAUFFMAN, DIRECTOR OF SALES

(CA License No: 0H45598)

Retirees, Make Sure You Maintain

Membership and Access to Club Benefits

Hello Retirees!

Celebrate your incredible tenure with the City, and embrace the start of an exciting new chapter! Your years of service deserve recognition. But don’t forget to prepare for the amazing opportunities that lie ahead. This is just the beginning of an extraordinary new season in your life!

First step: If you have not contacted the Club yet to complete a form to have your Club Membership and/or insurance deducted from your pension, please do so ASAP! Even if you are not newly Retired, please call (800) 464-0452 or email help@employeesclub.com and let us know that you are a Retiree and need to complete a pension form. Never worry about a bill or late payment. Pension deduction is the most convenient and easiest way to handle your deductions. Offered to Club Members.

Second step: Protect your family from financial loss by applying for the Club’s Life Insurance.

- Coverage is available for Members, spouses, and dependent children

- Benefits range from $10,000 to $50,000.

Speak to a Club Retirement Specialist. Don’t wait!

Club Life Insurance Designed for Retirees

Lets discuss Retiree Life Insurance!

Have peace of mind knowing that your loved ones will be taken care of in the event of your passing:

- A life insurance benefit can help pay for things such as final expenses, outstanding debt and loss of income.

- Life insurance can also be used to replace all or a part of your spouse’s pension benefits.

- The Club provides Group Rated Term Life Insurance for its Members, convenient payroll deduction, and an in-house claims department that works directly with your loved ones to make sure the claims process is as seamless as possible.

Continue Your Club Connection!

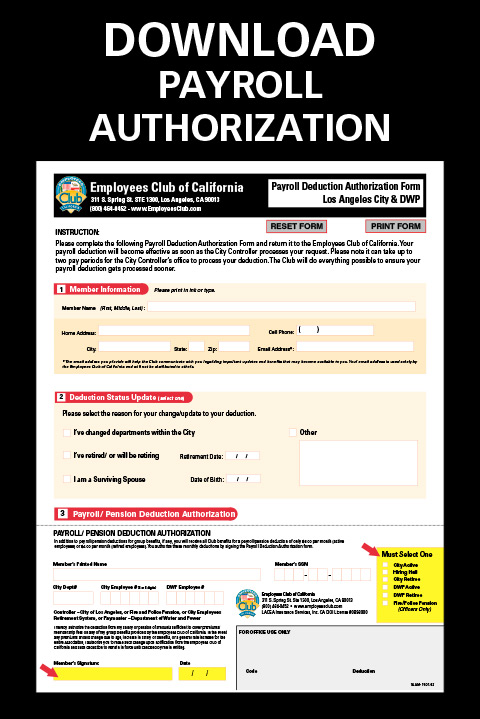

Attention! If you’re planning on retiring soon, newly Retired, or have been Retired but want to switch your deductions to be conveniently deducted from your pension, you must complete this Authorization Form. Without this form, your insurances and Membership might be discontinued, or you may incur back dues.

Attention! If you’re planning on retiring soon, newly Retired, or have been Retired but want to switch your deductions to be conveniently deducted from your pension, you must complete this Authorization Form. Without this form, your insurances and Membership might be discontinued, or you may incur back dues.

Download the form here, complete it and email it to info@employeesclub.com. Or mail it to:

Employees Club of California

Attn: Member Services

311. S. Spring St., Suite 1300

Los Angeles, CA. 90013

Questions? Don’t hesitate to contact our Retiree specialists at

info@employeesclub.com or (800) 464-0452

![]()

![]()

Resources for Club Retirees or Those About to Retire

2023 EventsDec. 16, 2023 LARFPA Holiday

|

Contact InformationEmployees Club of California LA City Employees’ Retirement System (LACERS) (City Dept.) LADWP Retirees Association Fire and Police Pensions (City Dept.) LA Retired Fire and Police Association (LARFPA) Retired Los Angeles City Employees, Inc. (RLACEI) |

LACEA Insurance Services, Inc. (Employees Club of California) is a licensed insurance agency offering insurance benefits to qualified Club members. The Club’s CA DOI Lic. is #0B98000.

For ACTIVE MEMBERS

Are You Ready for Retirement?

Here are some current programs to help with your planning:

Webinars

Learn about your retirement options and benefits at an upcoming Planning for Retirement webinar, hosted by the LACERS Member Engagement team. Register via your MyLACERS account. Upcoming dates include:

Sat., Oct. 21 (in person)

Tues., Nov. 7 (webinar)

Thurs., Nov. 16 (webinar) (Tier 3)

Sat., Nov.. 18 (webinar)

Thurs., Nov. 19 (webinar)

All webinars/events begin at 9 a.m.

Applying for Retirement Online

Members are encouraged to submit their retirement application 60 days before their retirement date when using LACERS’ new Retirement Application Portal (RAP). The RAP is a great asset to LACERS Members that helps to streamline the retirement process. While the filing period is within 30 to 60 days of your retirement date, starting your application early and submitting it on the first day you can at the 60-day-prior mark, will allow for a couple of benefits. These include having ample time to discover any complications and address them without having to move your retirement date, as well as ensuring LACERS staff has time to meet your retirement date request.

For example, if your desired retirement date is Feb. 10, 2024, you would have aimed to submit your retirement application in the portal on Dec. 12, 2023. For more information, please visit

![]()