As the Club’s quiet but critically important Claims Dept. surpasses an astonishing $100 million in insurance benefits paid, it continues to advocate strongly for Club Members.

The Club’s Insurance Claims Dept. works quietly, privately and professionally. In their critically important task of taking care of Club Members who carry Club insurance products and who have experienced deaths, disabilities and sicknesses in their families, quiet is necessary, and quiet is good.

But Alive! thought it was time to suspend the quiet for just one month, because a remarkable milestone has been achieved: As of this month, the Club has returned $100 million in payouts to some 50,000 Members who hold or have held insurance products from the Club. That remarkable total is just since 1992, for when the Club still has records. (The Club has been offering insurance products to its Members since the association’s founding in 1928.)

The Claims Dept. – Cecilia Talbot, Director of Claims and Member Advocate, 21 years of Club service; and Monica Zamudio, Claims Administrator, 9 years – is so much more than management. Cecilia and Monica are member advocates, helping Members get through the paperwork at perhaps the worst time in their lives, and advocating for the Members as they navigate the insurance claims process. They believe in Club Members and work tirelessly on their behalf.

In this month’s Alive! Interview, Cecilia and Monica, with Club Chief Operating Officer Robert Larios, talk about the milestone, why buying Club insurance is smart, and why they’re passionate about taking care of Club Members in their time of need.

In this month’s Alive! Interview, Cecilia and Monica, with Club Chief Operating Officer Robert Larios, talk about the milestone, why buying Club insurance is smart, and why they’re passionate about taking care of Club Members in their time of need.

Congratulations, Cecilia and Monica, for your awesome work!

Trust and Advocacy

On March 5, the Club’s Claims Dept. – Cecilia Talbot, Director of Claims and Member Advocate, 21 years of Club service; and Monica Zamudio, the Claims Administrator, 9 years – and Chief Operating Officer Robert Larios, 21 years, were interviewed by Alive! editor John Burnes. The interview took place in Club Headquarters on Spring Street.

|

|

|

Thanks for sitting down to talk to Alive! today on this amazing moment – $100 million in insurance claims paid back to Club Members by the Club. You’re in the paper and online every month with the claims updates, but this is the first time you’ve been featured. It’s about time!

Cecilia Talbot: Right, thanks.

But first, let’s go back and talk about your histories with the Club. We’ll start with you, Robert.

Robert Larios: I was just out of the University of Southern California when I joined the Club. Had some part-time work and internships like Cannon Corporation. I even worked on a yacht as a chef for three months.

I didn’t know that.

Robert: Yes. And then the opportunity to come to the Employees Club as a Member Services Counselor, an entry-level position, was available to me. I did that for a couple of years. I moved up to Marketing Coordinator and then a couple years after that to Sales Operations Manager, Director of Communications, Vice President of Operations and now Chief Operating Officer. All of that in 21 years.

How about you, Monica?

Monica Zamudio: I have worked in customer service since 1998, while I worked on getting my Bachelor of arts degree in child development with credentials. I graduated in 2003. I worked for a nonprofit organization with children with learning disability for a few years. I did interventions with the children to try to find the best way to help them learn, read and write. I also worked with the parents to help them work with the children in teaching them tools on how to help the children at home. I began working with the Employees Club in January 2010 as Claims Assistant, then Claims Coordinator. Presently I’m the Claims Administrator.

Great. How about you, Cecilia?

Cecilia: Before I came to the Club I was teaching Greek in a university in Argentina and in the San Francisco Theological Seminary.

Interesting.

Cecilia: I decided to look for a full-time job, so I came to work here as a substitute first. And then after three months, Brian Trent, the Club’s Chief Financial Officer, hired me. He said he didn’t have a better option!

[The panel laughs.]

My background is in theology, so I had to learn about insurance and claims. I thought we could do more than just help the members with the claim forms. I studied the City and DWP benefits and got familiar with City’s and DWP’s workers compensation plans. With that knowledge, I worked with the insurance companies to reduce paperwork, streamline the claim process and even re-interpret the policy to accommodate our members’ reality.

I remember one case where our Club Member had accidental death insurance, and because of his situation, he was going to lose his house. He needed the claim money urgently. Robert—at that time in Member Services—went to the hospital so the Member could sign an authorization. Robert then went to the police office to get the police report. When Robert came to the Club HQ, I was waiting for him. It was Friday afternoon. I put the member’s claim together and faxed it to the insurance company. By Monday the claim was approved and sent electronically to the bank. And his house was saved.

Wow.

Cecilia: The different Club Departments worked toward a common goal of going above and beyond to serve our members

That kind of tells you all you need to know right there, doesn’t it?

The Milestone

The Milestone

We are here this month specifically because the Club’s Claims Dept. has reached a remarkable milestone – $100 million in claims paid to Club Members. Congratulations to you, and to Club Members, too. What does that milestone mean to you?

Monica: It’s amazing. It shows all the people who were taken care of during the difficult times they were going through. It’s huge because our Members can have that confidence with our company – they can trust us to pay their claims, and work for them.

Monica: It’s amazing. It shows all the people who were taken care of during the difficult times they were going through. It’s huge because our Members can have that confidence with our company – they can trust us to pay their claims, and work for them.

Cecilia: Approximately 50,000 people have received claims from the Club.

50,000?

Cecilia: Yes, many people might be afraid to apply for insurance. I remember a Member from the DWP, he didn’t want to apply for claims he had a right to. He said, “The insurance company won’t pay when it matters. They will find any excuse not to pay.” I challenged him to try the Club, and his insurance paid, of course. His disability claim helped him through the moments nobody plans for.

Right.

Cecilia: $100 million is a lot of people helped. Many lives were saved through the Club. We are here to make sure our Members have a healing claims experience and get the money they expect.

From the Beginning

So talk about that for a little bit. What you do is fundamental and central to what the Association is all about, and what the Club does.

Cecilia: Sure. The Club has two different sections. One is fun, and the other is rescue. Alive! covers both.

The fun part is the amusement parks, the movie tickets, the tremendous discounts. The other part is claims. The insurance side is the reason we were created – to provide benefits. Insurance is the center of the company.

Robert: When people buy insurance with the Club, they’re buying peace of mind.

Cecilia: Yes – not just that the claims payment will be there, but that the process through the Club will be smooth and fluid.

Monica: It’s as stress-free as we can make it, and we’re always striving to improve. Our main focus is to make sure that when they file a claim, they’re already going through a lot of stress. So our main goal is to be there for them. We’re going to help them any way we can to make this process easy and smooth. We don’t add to the stress, we aim to remove it.

Robert: That’s right, Monica. The stress removal is geared for the removal of all stresses; starting with the phone calls, the paperwork, to the communications with the insurance carriers, and all the nuances in between. Cecilia and Monica are the experts. They have experienced thousands of member cases. They know the processes from start to finish and do everything they can to fulfill our obligation to provide Members with benefits and services. Part of Cecilia’s title includes the phrase ‘Member Advocate’. And with good reason.

Right. You really help people through what must be the most difficult time in their life.

Cecilia: Sometimes a Member says, “I need to file a claim. I don’t know if I have to see an attorney to help me.” I say, “You have me.” They really feel that we’re their advocates.

Monica: We’re on the Members’ side 100 percent. We’re there for them.

Quiet But Critical

You might be the quietest part of the Club, and yet right at the top of the most important.

Monica: We’re behind the scenes but we’re very important because we’re here helping the Members out to make sure everything goes smoothly.

Robert: This is a very serious component of the organization. When a Member or family member experiences an injury or a death, it is a life and death situation, an experience that no one should go through. But, Cecilia and Monica have helped Members through it thousands of times. There must be a human factor of empathy and sympathy. That’s a gift that you both have.

Monica: It can be tough, yes.

Cecilia: Sometimes I cry with a Member on the phone. But I still have to go ahead with the process. The two things together can be so difficult for a person who doesn’t have the temperament we have. You put their suffering in context and give them hope.

Robert: One can hear and sense Cecilia’s emotion – that’s real folks.

Cecilia: The person on the other side of the phone can know and feel that you suffered with them and you cried with them; you are now family. You are related now. And then they trust you with their lives.

That is earned.

Monica: Exactly.

One person at a time, one claim at a time.

Monica: Yes.

How important is compassion in what you do every day?

Monica: Huge. We’ve all gone through a death. You put yourself in their position and you feel it. You feel their emotion.

Cecilia: Compassion is sharing their burden in the best possible way and standing with them side by side in their time of trouble.

Compelling Stories

Any other stories that have stuck with you over the years?

Monica: Yes. One Member had just started with the City, and she was in a terrible car accident. She was out of work for quite a few years. And she had just bought a home. She lived on her own. She was devastated because she didn’t know how she was going to pay her mortgage. What was she going to do? She was going to lose her house. But she had long-term disability insurance with the Club, which covered 60 percent. In the end she was okay. We were there for her.

Right.

Monica: She bought the insurance. We helped her. We guided her through the process. It was the emotion and the pain she was going through that made it so hard for her. But we helped her through it.

Cecilia: I remember a Member who was in a very stressful situation. After it was over, he sent me a card, saying, “You made a big difference in my life and I was able to save myself and my family.” Another member said: “The City Employees Club is a blessing to the City employees. If I rated you on the scale from 1 to 10, 10 being the best, you rate a 20-plus. The City Employees Club has always been dedicated to helping its members. Your theme should read: Dedicated to Helping.” They applied for insurance, and they got what they needed at the time they needed it the most.

True to the Mission

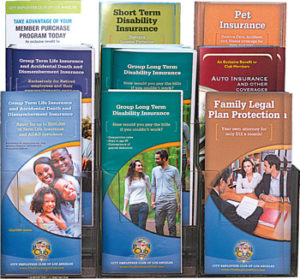

Give Members a rundown of all the insurance products available to them.

Cecilia: We offer life insurance; life-dependent insurance; accidental death and dismemberment; accident plan; long-term disability; long-term care; short-term disability; cancer; and critical illness plans. The Critical Illness plan covers heart conditions, organ transplants, internal cancer and burns.

What did the Association start with in 1928?

Robert: While records are sparse about the early days of the association, indications suggest that the onlu benefits and services that were offered in 1928 were life insurance and accidental death and dismemberment insurance, and that remained unchanged for decades.

Cecilia: Yes.

Robert: Then in the 1980s, long-term disability or some form of disability insurance was introduced. In the 1990’s, Long Term Care insurance, auto insurance, cancer insurance and pet insurance were added to our menu of benefits.

Cecilia: We introduced long-term care plans in 1992.

Has anything changed over the decades? Have you noticed any emphasis on one thing?

Cecilia: Yes. In the beginning, the main benefit was life. Then life and disability were important. Then we added long-term care. Currently, long-term care is gaining more importance because the amount of awareness of Alzheimer’s and Parkinson’s diseases.

Also, people are living longer, and we are more exposed to the weakness of old age.

You’re still true to the Association’s mission that was formed in 1928.

Cecilia: Yes, absolutely. We want more than Members. We want the best benefits for them.

Are you proud to be carrying on a 90-year-old tradition?

Monica: Yes, it’s amazing. I’ve never worked for a company like the Club, honestly. It’s amazing. The way we care about the Members – customer service is amazing. I’ve never been in a company that actually works the way we do.

Robert: The Employees Club will carry on for another 90 years because of that mindset – about helping the employees, helping their families, doing what’s best for them with compassion, and seeing them through the suffering and also through the good times. The Employees Club is a life and work partner for employees and their families.

In a number of years be we could be looking at a $200-million milestone. But again, it won’t be about the dollar, it’ll be about the people.

Monica: Yes. We helped them.

Cecilia: Something I think is important is who is responsible for this mentality in the company. At the beginning it was City employees who started this, and City employees are still on the board today. That is important.

And then I think the person who shaped our company beyond any other company is John Hawkins, our CEO. He is willing to do whatever it takes, even humble tasks, to help us do our job. If you don’t have that mentality – doing whatever it takes to serve our Members – you don’t survive here. You have to be able to do that.

A Passion for Helping People

What do you love about what you do?

Cecilia: I like helping people. When they are in trouble, I tell them that there’s a God, and to rest in him. When you are in those situations, you have to believe in something beyond the clouds.

I feel good about the very strong relationships I have made with Members.

The other thing I love is doing reports. Really! I have my own way of making sure that our products are working well. We are not leaving anybody behind, and everything works fine. We need to make sure we have not missed a single detail, because one single detail missed can really disrupt a life that’s under stress.

No one gets lost.

Cecilia: Exactly.

What have you learned?

Cecilia: I learned that definitions matter. A few years ago, when we switched insurance carriers, their definition of cancer changed. This change did not favor our Members. I agreed with the definition from our former carrier, but not of the new one. And this really mattered. So I researched it pretty deeply. I showed the second carrier that they were misun¬derstanding the definition. So the new carrier changed the understanding of the definition, not just for our Members but for all the companies they worked with.

Really?

Cecilia: I feel satisfied because many people, not just our Members, are helped while standing up for our Members.

You’ve even helped people who weren’t Members of the Club?

Cecilia: Of course. The Director of Claims at an insurance company told me they changed totally their understanding of the policies for all their policyholders, not just ours.

Robert: Claims also gets involved when an insurance carrier is not performing at the level that is expected for our members. That is when Cecilia and Monica get involved to provide valuable insight to identify good partnerships with current and new insurance carriers. Their evaluation includes onsite inspections of insurance companies anywhere in the nation.

Cecilia: You need to, really.

Right.

Robert: We’ll go to those lengths because we know how important the Claims perspective is for the organization and for the Member.

Monica, what do you love about what you do?

Monica: Helping the Members. That’s honestly what I’m dedicated to. Making sure that they’re going to be okay and don’t have to worry about anything – that’s what I’m dedicated to.

And that, along with the milestone of $100 million in claims paid, is really what we’re celebrating this month.

Robert: Yes. It is astonishing that it’s already $100 million in benefits paid. It’s too bad that we don’t have records of what has been paid since our beginning in 1928. We don’t know what that number is. And that’s okay because we do know that, in this short period of time since 1992, we’ve helped 50,000 people. All of us do this every day with a sense of gratification. We feel the reward, and the reward is helping that Member, one Member at a time. We don’t know exactly what the next decades will bring us, but it’s going to be an astonishing time.

Monica: It will be all about the Members 100 percent, just like it has always been, and is now.

Right. Congratulations on this milestone, and Godspeed for the next milestone.

Cecilia: Thank you.

Monica: Thank you.

…BEHIND THE SCENES

The Club’s Director of Marketing, Summy Lam, travels a few offices away to capture the Club’s Claims Dept. – Cecilia Talbot (left) and Monica Zamudio. |