by Noelle Kauffman, Director of Sales

by Noelle Kauffman, Director of Sales

(CA License No: 0H45598)

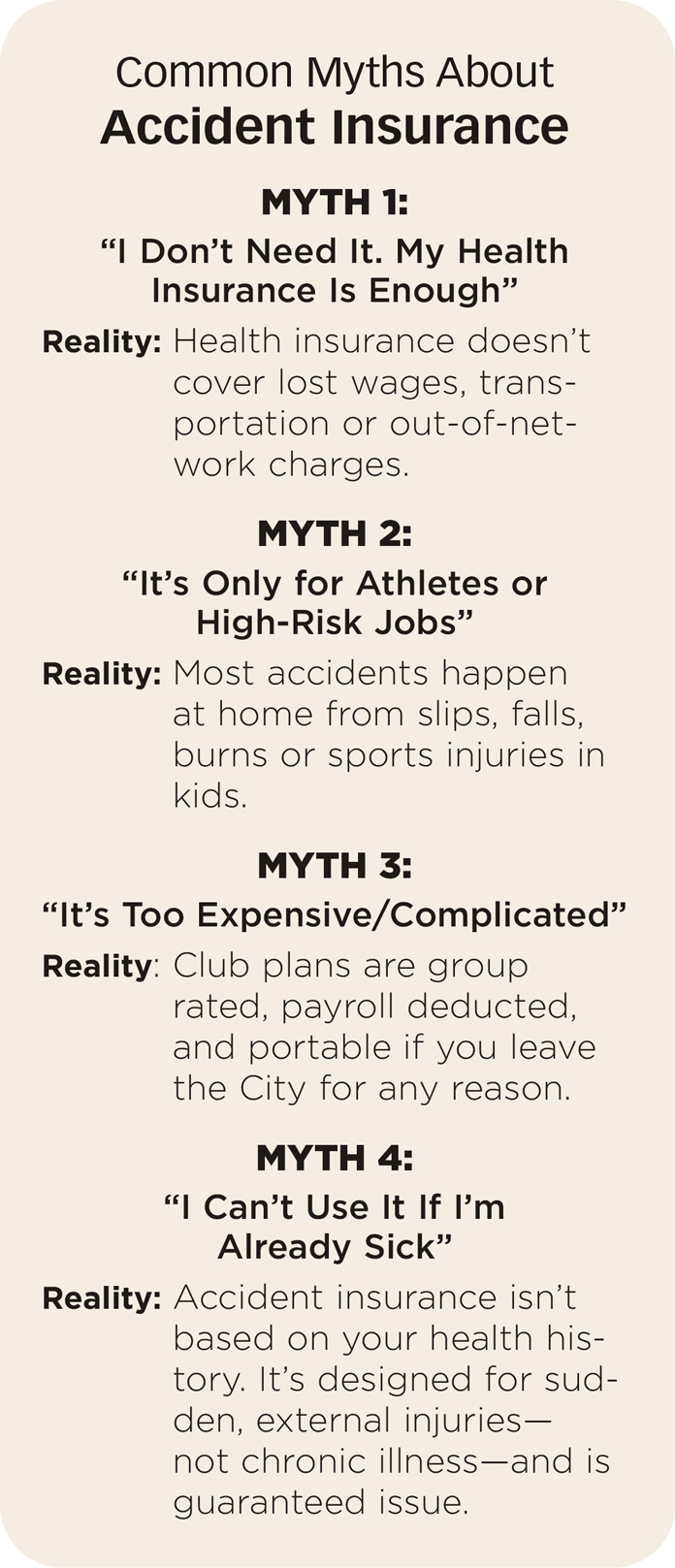

Myths and facts about accident insurance.

Imagine this: You are walking down your stairs, you trip on a loose tile and end up with a broken wrist. Now you are out of work for a week, paying for X-rays, follow-ups, and physical therapy. Health insurance may cover some of it, but what about your lost wages, deductibles, or childcare while you recover?

That’s where the Club’s Accident Insurance comes in.

What Is Accident Insurance?

Accident insurance is a supplemental policy that provides a lump-sum payout when you suffer a covered accidental injury. It typically covers:

- Emergency room visits

- Hospital stays

- Ambulance rides

- Fractures, sprains, dislocations

- Follow-up care like physical therapy

It is not a replacement for health insurance, but it can be used as a financial buffer to help with out-of-pocket costs when the unexpected happens.

Why It’s Important

Here’s why Accident Insurance through the Club is a smart idea.

- Rising Medical Costs: Even with good health insurance, deductibles and co-pays can add up fast.

- Family Coverage: Kids are accident-prone, and many policies cover dependents too.

- Gig Workers and Contractors: If you are not covered by workers’ comp, this can provide a financial safety net.

- Quick Payout: Claims are paid out directly to you.

Accidents don’t wait for the “right time.” Whether you’re a parent, a freelancer, or just someone who wants peace of mind, accident insurance is a low-cost way to protect yourself financially from life’s literal slip-ups.

To learn more, email info@employeesclub.com

to speak with a Club Counselor today.

You’ve taken care of Los Angeles. Now let us take care of you.

To speak with a Club Counselor today, email help@employeesclub.com

Your Club Retirement Experts

We’re here to serve you!

Update your benefits and get all of your questions answered by booking a one on one or group presentation appointment with your colleagues at your job site.

Email help@employeesclub.com to request a Counselor visit today!

Resources for Club Retirees or Those About to Retire

2025 EventsLARFPA LADWP Retirees Association Reservation information: |

Contact InformationClub Retirees Dedicated Helpline: LA City Employees’ Retirement System (LACERS) (City Dept.) LADWP Retirees Association Fire and Police Pensions (City Dept.) LA Retired Fire and Police Association (LARFPA) Retired Los Angeles City Employees, Inc. (RLACEI) |

For ACTIVE MEMBERS

Ready to Retire? Use the Decision Shee

Here are the upcoming programs to help with your planning.

The Retirement Decision Sheet is a guide for important decisions to be made during the retirement process. Service Retirement Unit (SRU) Counselors at LACERS often utilize these sheets during counseling appointments with members, and based on months of usage, changes have been made to create a new, improved decision sheet. Check it out at this link:

LACERS is committed to helping its members achieve the best retirement possible.

Sign Up for Retirement Benefits Seminar

Here are the upcoming programs to help with your planning.

Learn about your retirement options and benefits at an upcoming Planning for Retirement webinar, hosted by the LACERS Member Engagement team. Register via your MyLACERS account. Upcoming dates include:

Tues., July 1 (Tier 3) (webinar)

Thurs., July 10 (webinar)

Sat., July 19 (in person, LACERS HQ)

Wed., July 23 (webinar)

Tues., Aug. 5 (webinar)

Check the LACERS calendar as events are scheduled.

Webinars/events begin at 9 a.m.

Applying for Retirement Online

Members are encouraged to submit their retirement application 60 days before their retirement date when using LACERS’ new Retirement Application Portal (RAP). The RAP is a great asset to LACERS Members that helps to streamline the retirement process. While the filing period is within 30 to 60 days of your retirement date, starting your application early and submitting it on the first day you can at the 60-day-prior mark, will allow for a couple of benefits. These include having ample time to discover any complications and address them without having to move your retirement date, as well as ensuring LACERS staff has time to meet your retirement date request.

For example, if your desired retirement date is Sept. 20, 2025, you would have aimed to submit your retirement application in the portal on July 22, 2025. For more information, please visit lacers.org/applying-retirement.

![]()